News and Politics

-

पांच गुना महंगा हुआ ताजमहल का दीदार, गुंबद में जाने का अलग चार्ज, ये होंगी नई दरें

- December 10, 2018

विश्व के सात आश्चर्यों में शुमार ताजमहल की एंट्री फीस बढ़ा दी गई है। वहीं अब गुंबद के अंदर जाने के लिए भी अलग से शुल्क भुगतान करना होगा।

मोहब्बत की मिसाल और दुनिया के सात आश्चर्यों में शुमार एकमात्र भारतीय विरासत ताजमहल का दीदार अब और महंगा हो गया है। संगमरमर की इस खूबसूरत कलाकृति को देखने के लिए अब पहले से पांच गुनी रकम खर्च करनी पड़ेगी। भारतीय पुरातत्व सर्वेक्षण ने 10 दिसंबर से नई दरें लागू कर दी है। बताया जा रहा है कि भीड़ के प्रबंधन की दृष्टि से यह फैसला लिया गया है।

देशी-विदेशी सभी पर्यटकों के लिए महंगा:

10 दिसंबर से भारतीय पर्यटकों के 250 रुपए देने होंगे, इससे पहले 50 रुपए का टिकट होता था। इसके अलावा विदेशी पर्यटकों के लिए भी एंट्री फीस में इजाफा किया गया है। पहले उन्हें 1100 रुपए देने होते थे लेकिन अब 1300 रुपए प्रति टिकट लगेंगे। इतना ही नहीं जो पर्यटक कब्र वाले गुंबद में जाना चाहते हैं उन्हें 200 रुपए अतिरिक्त चुकाने होंगे। यह शुल्क नहीं चुकाने वाले लोग सिर्फ ताजमहल के प्लेटफॉर्म से चारों तरफ यमुना का नजारा देख सकेंगे। उन्हें अंदर जाने की इजाजत नहीं होगी।सुरक्षा और संरक्षण दोनों में मिलेगी मदद:

दरअसल माना जा रहा है कि ताजमहल की सुरक्षा और संरक्षण दोनों की वजह से यह कदम उठाया जा रहा है। इससे भीड़ पर भी नियंत्रण होगा और राजस्व में भी वृद्धि होगी। ताजमहल को लेकर कई बार विवाद होते रहे हैं। इसके रखरखाव को लेकर हाल ही में सुप्रीम कोर्ट ने भी फटकार लगाई थी। ताजमहल की हालत से आहत सुप्रीम कोर्ट ने हाल ही में कहा था कि संभाल नहीं सकते तो इसे ध्वस्त कर दो। अब तक नई दरों पर कोई सियासी प्रतिक्रिया सामने नहीं आई है।Source: https://www.jansatta.com/rajya/uttar-pradesh/entry-fees-to-enter-to

-

MP चुनाव: देर रात बदला ये नियम, देरी से आ सकते हैं नतीजे

- December 10, 2018

-

राजधानी दिल्ली का सिग्नेचर ब्रिज चालू, जानिए पांच दिलचस्प बातें

- November 5, 2018

-

-

Govt bans Vat 69, Smirnoff sale in Delhi for two years

- September 21, 2018

Entertainment

-

पांच गुना महंगा हुआ ताजमहल का दीदार, गुंबद में जाने का अलग चार्ज, ये होंगी नई दरें

- December 10, 2018

विश्व के सात आश्चर्यों में शुमार ताजमहल की एंट्री फीस बढ़ा दी गई है। वहीं अब गुंबद के अंदर जाने के लिए भी अलग से शुल्क भुगतान करना होगा।

मोहब्बत की मिसाल और दुनिया के सात आश्चर्यों में शुमार एकमात्र भारतीय विरासत ताजमहल का दीदार अब और महंगा हो गया है। संगमरमर की इस खूबसूरत कलाकृति को देखने के लिए अब पहले से पांच गुनी रकम खर्च करनी पड़ेगी। भारतीय पुरातत्व सर्वेक्षण ने 10 दिसंबर से नई दरें लागू कर दी है। बताया जा रहा है कि भीड़ के प्रबंधन की दृष्टि से यह फैसला लिया गया है।

देशी-विदेशी सभी पर्यटकों के लिए महंगा:

10 दिसंबर से भारतीय पर्यटकों के 250 रुपए देने होंगे, इससे पहले 50 रुपए का टिकट होता था। इसके अलावा विदेशी पर्यटकों के लिए भी एंट्री फीस में इजाफा किया गया है। पहले उन्हें 1100 रुपए देने होते थे लेकिन अब 1300 रुपए प्रति टिकट लगेंगे। इतना ही नहीं जो पर्यटक कब्र वाले गुंबद में जाना चाहते हैं उन्हें 200 रुपए अतिरिक्त चुकाने होंगे। यह शुल्क नहीं चुकाने वाले लोग सिर्फ ताजमहल के प्लेटफॉर्म से चारों तरफ यमुना का नजारा देख सकेंगे। उन्हें अंदर जाने की इजाजत नहीं होगी।सुरक्षा और संरक्षण दोनों में मिलेगी मदद:

दरअसल माना जा रहा है कि ताजमहल की सुरक्षा और संरक्षण दोनों की वजह से यह कदम उठाया जा रहा है। इससे भीड़ पर भी नियंत्रण होगा और राजस्व में भी वृद्धि होगी। ताजमहल को लेकर कई बार विवाद होते रहे हैं। इसके रखरखाव को लेकर हाल ही में सुप्रीम कोर्ट ने भी फटकार लगाई थी। ताजमहल की हालत से आहत सुप्रीम कोर्ट ने हाल ही में कहा था कि संभाल नहीं सकते तो इसे ध्वस्त कर दो। अब तक नई दरों पर कोई सियासी प्रतिक्रिया सामने नहीं आई है।Source: https://www.jansatta.com/rajya/uttar-pradesh/entry-fees-to-enter-to

-

Forbes’ highest-paid actors and actresses of 2018

- September 24, 2018

Each year, Forbes releases its list of highest paid actors and actresses. Take a look at the top 20 stars

Fun

-

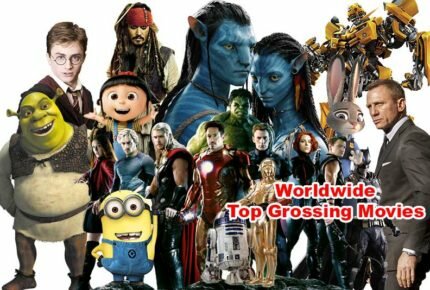

Worldwide Top 50 Highest-grossing Blockbuster Movies

- October 18, 2018

1 – Avatar 2009

Worldwide gross Earning: $2,787,965,087

2 – Titanic 1997

Worldwide gross Earning: $2,187,463

-

Forbes’ highest-paid actors and actresses of 2018

- September 24, 2018

-

Catch – 22, एक असंभव लेकिन मजाकिया परिस्थिति

- October 10, 2017

-

10 मिनट में हेलीकॉप्टर से दिल्ली दर्शन, वो भी केवल 2500 रुपये में

- March 23, 2017

-

हद है मूर्खता की! गए थे एटीएम चुराने, उठा लाये पासबुक प्रिंटिंग मशीन

- September 14, 2016

Photo

Movies

-

Worldwide Top 50 Highest-grossing Blockbuster Movies

- October 18, 2018

1 – Avatar 2009

Worldwide gross Earning: $2,787,965,087

2 – Titanic 1997

Worldwide gross Earning: $2,187,463

-

इस फिल्म मेकर ने बाहुबली-2 में ऐसी 5 कमियां निकाली कि राजमौली को उत्तर देने के लिए मजबूर होना पड़ा

- May 4, 2017

-

-

गार्जियंस ऑफ़ द गैलेक्सी – 2 (मार्वेल): पहला टीजर जारी, जरूर देखें

- October 20, 2016

Travel

-

Cambridge Travel Guide: Get full and correct information

- January 18, 2019

Cambridge is one of the most beautiful and traditional cities. It is an amazing destination in which the visitors can

-

पांच गुना महंगा हुआ ताजमहल का दीदार, गुंबद में जाने का अलग चार्ज, ये होंगी नई दरें

- December 10, 2018

विश्व के सात आश्चर्यों में शुमार ताजमहल की एंट्री फीस बढ़ा दी गई है। वहीं अब गुंबद के अंदर जाने के लिए भी अलग से शुल्क भुगतान करना होगा।

मोहब्बत की मिसाल और दुनिया के सात आश्चर्यों में शुमार एकमात्र भारतीय विरासत ताजमहल का दीदार अब और महंगा हो गया है। संगमरमर की इस खूबसूरत कलाकृति को देखने के लिए अब पहले से पांच गुनी रकम खर्च करनी पड़ेगी। भारतीय पुरातत्व सर्वेक्षण ने 10 दिसंबर से नई दरें लागू कर दी है। बताया जा रहा है कि भीड़ के प्रबंधन की दृष्टि से यह फैसला लिया गया है।

देशी-विदेशी सभी पर्यटकों के लिए महंगा:

10 दिसंबर से भारतीय पर्यटकों के 250 रुपए देने होंगे, इससे पहले 50 रुपए का टिकट होता था। इसके अलावा विदेशी पर्यटकों के लिए भी एंट्री फीस में इजाफा किया गया है। पहले उन्हें 1100 रुपए देने होते थे लेकिन अब 1300 रुपए प्रति टिकट लगेंगे। इतना ही नहीं जो पर्यटक कब्र वाले गुंबद में जाना चाहते हैं उन्हें 200 रुपए अतिरिक्त चुकाने होंगे। यह शुल्क नहीं चुकाने वाले लोग सिर्फ ताजमहल के प्लेटफॉर्म से चारों तरफ यमुना का नजारा देख सकेंगे। उन्हें अंदर जाने की इजाजत नहीं होगी।सुरक्षा और संरक्षण दोनों में मिलेगी मदद:

दरअसल माना जा रहा है कि ताजमहल की सुरक्षा और संरक्षण दोनों की वजह से यह कदम उठाया जा रहा है। इससे भीड़ पर भी नियंत्रण होगा और राजस्व में भी वृद्धि होगी। ताजमहल को लेकर कई बार विवाद होते रहे हैं। इसके रखरखाव को लेकर हाल ही में सुप्रीम कोर्ट ने भी फटकार लगाई थी। ताजमहल की हालत से आहत सुप्रीम कोर्ट ने हाल ही में कहा था कि संभाल नहीं सकते तो इसे ध्वस्त कर दो। अब तक नई दरों पर कोई सियासी प्रतिक्रिया सामने नहीं आई है।Source: https://www.jansatta.com/rajya/uttar-pradesh/entry-fees-to-enter-to

Science

-

कार्दाशेव स्केल के अनुसार ब्रह्माण्ड में हम किस लेवल की विकसित सभ्यता पर हैं?

- March 23, 2018

अगर हम मानव विकास के क्रम को छोड़ सम्पूर्ण ब्रह्माण्ड में विकास की बात करें तो….. तो इसके लिए हमारे वैज्ञानिकों ने बहुत सारी रिसर्च की. इसमें से एक रिसर्च है वैज्ञानिक कार्दाशेव की. इन्होने सभ्यता को मापने के लिए एक पैमाना तैयार किया है, आइये जानते हैं कार्दाशेव और उनकी थ्योरी के बारे में.

-

अंतरिक्ष विज्ञानियों को मिले पृथ्वी के 7 भाई बहन, जीवन की संभावना!

- February 23, 2017

-

ISRO ने किया एक रॉकेट से रिकॉर्डतोड़ 104 उपग्रहों का प्रक्षेपण – दुनिया हैरान

- February 15, 2017

-

लॉकहीड SR-71 ब्लैकबर्ड – अमेरिकन एयर फ़ोर्स का यह जहाज आपके दिमाग की बत्ती गुल कर देगा

- September 22, 2016

-

दुनिया भौचक रह गयी जब भारत ने पहला ‘मेड इन इंडिया’ स्पेस शटल लॉन्च किया

- May 23, 2016

Beauty

-

Disha Patani Sizzles in a Black Monokini

- August 22, 2018

Disha Patani sent her fans into a frenzy by sharing yet another sultry snap of herself in a swimsuit. The actress is setting the temperatures soaring with her latest Instagram post, which features her in a black cutout mesh swimsuit.

-

ख़ूबसूरती बढ़ाएं दूध से

- June 23, 2017

दूध सेहत के लिए जरूरी तो है ही, सुंदरता बढ़ाने में इसका कोई जवाब नहीं है. दूध को इस्तेमाल कर आप त्वचा को कोमल बना सकती हैं. आइये जानते हैं दूध से किस तरह त्वचा को निखारा जा सकता है.

Hindi

-

विनती – एक छोटी सी हास्य कविता रमा तिवारी की

- September 26, 2018

-

हिंदी कहानी – गलती किसकी?

- September 21, 2018

-

क्या पूरा होगा दिवास्वप्न? हिंदी कविता

- March 26, 2018

-

ऐ खुदा, तुझसे नाराज हूँ – हिंदी कविता

- September 22, 2017

-

हिंदी कविता – अंतर्मन

- June 20, 2017

.png)